Forbes :

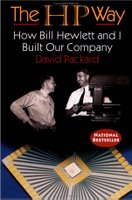

Hewlett-Packard's decision to purchase Mercury Interactive, the Israeli-American business-software developer, for $4.5 billion will turn Mercury's R&D center in Israel into HP's largest software development center worldwide. It's the company's largest acquisition since it bought Compaq Computer for $18.9 billion in 2002.

But it seems that the 700 new HP employees in Israel may have a reason for concern, at least if they were to consult their colleagues in HP Israel, the local division of global HP. Forbes Israel reports that in March, HP fired 15 senior executives in its Israeli division, including Chief Executive Gil Rosenfeld after it suspected they ran a gray market--exporting servers that should have been sold only in Israel to other countries for a higher profit. After investigations, hearings and legal fights, HP backed off and cleared Rosenfeld's name. However, Rosenfeld decided not to return to the company, leaving the division in turmoil.

Now, HP Israel's employees are in a panic. They refuse to talk, afraid of eavesdropping and denunciation, while checking other employment opportunities. In April, HP's server sales in Israel dropped 40%, and clients claim that sales might continue to drop in the next quarters. Still, HP says that the quarterly results of the Israeli division match its expectations.

According to information that was leaked to reporters, HP Israel was accused of illegitimately exporting 30,000 servers--half of the total amount imported to Israel each year--for $50 million. By running this kind of gray market, HP Israel could benefit, for example, from the higher price of the servers among foreign trading partners, and from the differences in exchange rates. However, while HP Israel gains, the local HP distributor in the destination country loses, and so does the parent company, whose global sales plans are foiled.

Rosenfeld was fired during lunch. His pink slip was sent to his iPAQ while he was dining with a CEO of a major Israeli company. "Dear Gil," the message on his iPAQ read. "As you know, during the last weeks we conducted an investigation…and found evidence that tie you to severe violation of company procedures....Due to the findings, HP considers to terminate your employment with the company." Rosenfeld denies any gray market activity in the Israeli division. "HP was misled--it was victimized," he says. "I'm not looking for revenge, and I don't want to talk against HP. It was my home for 18 years. I loved it, and I still love it."

The exact details of the investigation were never publicly disclosed, but toward the end of 2005, and perhaps earlier, HP received complaints about gray-market activity in its Israeli division. The complaints may have been lodged by executives of other HP divisions in Europe, and possibly, as Rosenfeld implies, they were lodged by local workers who were seeking ways to hurt him after he laid them off. "People were looking for revenge," he says.

In mid-February, a team of American and British investigators landed in Israel. For five weeks, they interrogated employees and searched for evidence in files and computers. Some employees claim that the investigators even monitored their calls. The probe eventually found its way into the Israeli media. Newspapers were given details on what the team of investigators was seeking. "The team will investigate senior officials in the local division due to suspicions about severe violations of the company's procedures," wrote Maariv, Israel's second-largest newspaper. "If the suspicions will be realized, some senior officials in HP Israel might lose their jobs."

And they did. But Rosenfeld decided not to give up without a fight. "Getting the pink slip was the shock of my life," he says. "I decided to fight the company I love to clear my name. I was angry, and my family helped me a lot. My legal counsel was Tamar Golan, who is my mother-in-law, and together with my wife and father, we created a think tank. We worked day and night. It was an amazing team effort."

HP refused to present Rosenfeld with the investigation's findings, and the case arrived in Israel's labor court. The court ruled that HP should present the report to Rosenfeld and the other executives whose jobs were terminated. Those who've read the report under a pledge not to disclose its contents are able to testify about what it doesn't contain--any real evidence against the executives.

After a mediation process, Rosenfeld was cleared of any suspicion, though the situation of the other executives dismissed at the same time remains unclear. HP released a statement asserting that it had never cast any doubt on Rosenfeld's integrity, nor his achievements, and regretted the misleading media coverage that was made without its knowledge or consent.

The crisis between Rosenfeld and HP lasted exactly one month, from March 23 to April 23. Then, Rosenfeld decided to leave the company. "It was the right thing to do," he says.

Rosenfeld says HP should now take care of its employees. "The workers in Israel are an amazing group of people of superb quality. The only thing that the company needs to do now is to pet the workers, the clients and the market. The company needs a leader who is a 'man of heart,' because the damage is emotional, not rational."

HP's comment: "The company never discloses information about investigations related to its business regulations."

CEO Mark Hurd says the company's operational and information technology costs are still too high

CEO Mark Hurd says the company's operational and information technology costs are still too high

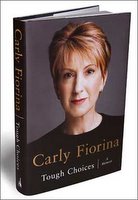

An open letter to Mark Hurd,

An open letter to Mark Hurd,